Things Florida Insurance Adjusters Don’t Want You to Know After an Accident

December 21, 2025 – Britto & Herman Injury Lawyers

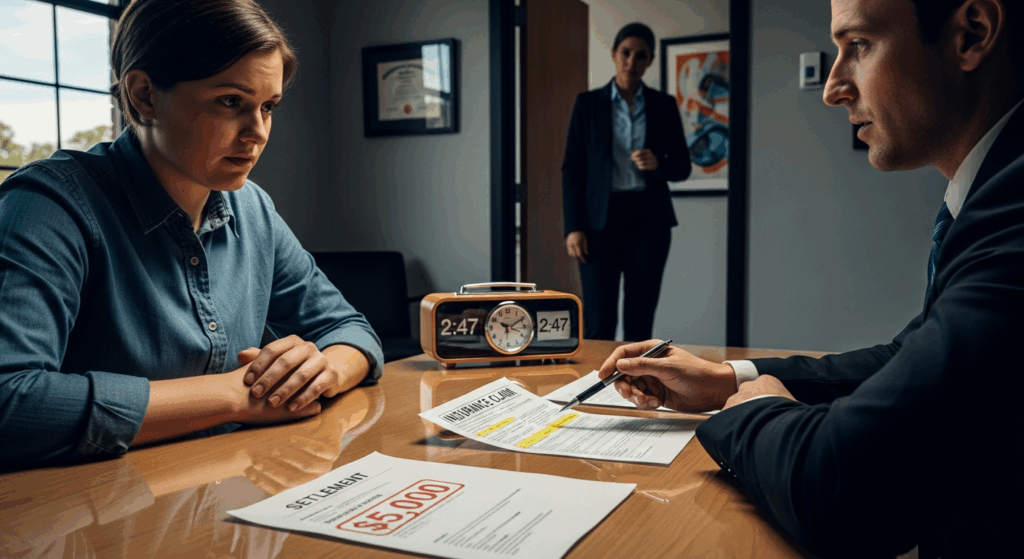

When the dust settles after a car crash, your first instinct is to trust your insurance company. You expect honesty and fairness, but it is important to know that many insurance company tricks after an accident are designed to prioritize profits over people. Knowing how to spot these insurance company tricks after an accident can make the difference between a fair recovery and a financial setback.

At Britto & Herman Injury Lawyers, our attorneys have spent years holding insurers accountable for unfair practices. Here’s what really happens when you file a claim and how to protect yourself from being taken advantage of.

What the Insurance Company Won’t Tell You: Key Takeaways

- Adjusters aim to reduce payouts, not maximize fairness.

- Avoid giving recorded statements without legal advice.

- Early offers undervalue claims.

- Florida law protects you from bad faith practices (e.g., Florida Statute 0627.736).

- A skilled auto accident lawyer in Florida ensures fair compensation and peace of mind.

Why Their Main Goal is to Use Insurance Company Tricks After an Accident

It is helpful to know that insurance adjusters are not advocates for victims; their primary role is to save the company money. They are often trained to use specific insurance company tricks after an accident to settle claims as quickly and cheaply as possible.

That’s why consulting an attorney early helps level the playing field and prevents insurers from exploiting loopholes.

Tactics Used to Get You to Admit Fault

An adjuster’s friendliness can hide a strategy. They might ask questions like, “Were you distracted?” or “Could you have avoided the accident?” These questions are designed to make you accept part of the blame. Under Florida’s comparative fault law (Florida Statute 768.81), even small admissions can reduce your payout. Stay polite, but don’t discuss fault details until your lawyer is present.

Why You Should Never Accept the First Offer

The first settlement offer is rarely fair. Studies from the Insurance Information Institute show that early settlements can undervalue injury claims by up to half their real value. Adjusters rely on stress, medical bills, and lost wages to push for quick settlements.

A personal injury lawyer can identify every cost you deserve, including future treatment, lost wages, and emotional distress. Taking time to review your claim often results in higher compensation.

The Importance of Recorded Statements (and Saying No)

When an adjuster asks to record your statement, it may sound routine, but it’s actually a risk. You are not required to provide a recorded statement to another driver’s insurer. These recordings can be twisted later. Respond with, “I’ll cooperate once I’ve spoken with my attorney.” This keeps your credibility intact.

Common Insurance Company Tricks After an Accident Involving Delays

A standard insurance company trick after an accident is simply to wait you out. Adjusters might say they are “still reviewing your file” to wear you down until you are willing to accept a much lower offer. Florida’s bad faith insurance statute (Florida Statute 624.155) allows victims to act if an insurer unreasonably delays or denies claims.

A report from the Bureau of Justice Statistics stated that half the auto tort cases were disposed of within 14 months. A lawyer ensures that every delay is documented and promptly challenged.

Psychological Pressure: How Adjusters Exploit Stress and Confusion

After a crash, victims face physical pain and financial strain. Adjusters use false sympathy or urgency to rush decisions. They might say that hiring a lawyer will slow your claim, but that’s untrue. An attorney ensures your case progresses smoothly and fairly.

Recognizing these tactics helps you stay calm and make informed decisions.

What “Bad Faith” Really Means Under Florida Law

Bad faith happens when an insurer acts unfairly toward a policyholder. Examples include ignoring valid claims, making low offers, or failing to provide clear explanations for decisions. Florida law requires filing a Civil Remedy Notice before initiating a lawsuit. This gives the insurer 60 days to correct issues.

Britto & Herman assists clients in filing notices and pursuing damages when insurers act in bad faith.

Recognizing a Lowball Offer

Lowball offers are common after crashes. Signs include vague math, no written explanation, or pressure to accept quickly. Victims can request a written breakdown of each settlement component. Comparing their figures with medical and repair costs exposes undervaluation.

Your Rights as an Injury Victim

Florida’s Unfair Insurance Trade Practices (Florida Statute 501.201-213) protects victims. You have the right to timely communication, clear explanations, and fair claim evaluation. If an insurer violates these standards, you can file a complaint with the DFS or seek legal action.

Working with a Florida personal injury attorney ensures your rights are respected and your claim receives proper attention.

When to Bring a Lawyer Into the Conversation

If you feel pressured or ignored by an insurer, it’s time to call an auto accident attorney in Florida. Legal counsel stops intimidation and ensures your evidence supports your claim. We handle negotiations, documentation, and representation so you can focus on healing.

Frequently Asked Questions: Your Helpful Guide

- What should I do if an adjuster calls right after my accident?

Avoid giving statements or signing documents. Refer them to your attorney. - Can I sue my insurer for bad faith?

Yes. Florida Statute 624.155 lets you file if your insurer negligently delays or undervalues your claim. But there are many prerequisites to bad faith claims that you should discuss with an attorney. - How long do insurers have to settle claims in Florida?

They must acknowledge claims within 14 days and resolve them within 90 days, unless there are disputes that require further investigation. - Is it legal for insurers to delay my claim?

Unjustified delays may constitute bad faith under Florida law (e.g., Florida Statute 0627.70131). - When should I hire a lawyer?

Immediately after an accident or when you notice a delay, pressure, or lowball tactics.

Get Help from Britto & Herman Injury Lawyers

Insurance companies have playbooks, but so do we. If your insurer delays, denies, or pressures you, contact Britto & Herman today for a free consultation. We’ll review your case, explain your rights, and handle the insurer while you focus on recovery. You pay nothing unless we win.

About Britto & Herman

Learn more about Britto & Herman’s personal injury attorneys, Daniel D. Britto and Michael S. Herman Jr., who bring years of courtroom experience and a proven record of results for accident victims throughout Jupiter and Palm Beach County. At Britto & Herman Injury Lawyers, we believe integrity and persistence are the keys to justice.

Ask a question, Describe your situation,

Request a Free Consultation

Contact Us And We’ll Tell You Everything You Need To Know!

Required Fields*

Your Information Is Safe With Us

We respect your privacy. The information you provide will be used to answer your question or to schedule an appointment if requested.